wildpixel

Markets have started a concerning downtrend since the beginning of this month. Retail data is demonstrating positive trends, suggesting a resilient economy, yet the SPDR S&P 500 ETF Trust (NYSEARCA:SPY) and Invesco QQQ Trust ETF (QQQ) appear increasingly uneasy.

Over the past months, market participants have been pricing in rate cuts, anticipating a dovish stance from the Fed in response to a successful “soft landing.” This pricing is embedded in the valuations of various assets, and particularly in tech stocks.

However, the recent wave of positive consumer data alters the narrative. The recent FOMC minutes indicate that inflation is still the primary focus of the Fed, and that further rate hikes are not off the table. This would be a stark pivot from what the market has been pricing in. If further rate hikes materialize, the richly priced market is due for a selloff.

AI Hype Factor

A significant driving force behind the recent bullish sentiments, especially within the tech-heavy indices like QQQ, has been the narrative surrounding generative AI. Artificial Intelligence represents one of the most transformative technological breakthroughs of the 21st century. Its potential applications have quickly made it an investor’s favorite.

This optimism isn’t unfounded: big tech companies, which form a considerable portion of indices like the Nasdaq, are among the frontrunners in AI research and implementation. Their vast resources, both in terms of capital and data, position them uniquely to benefit from and shape the AI revolution. As such, these tech giants are often viewed as some of the purest investment vehicles for those looking to gain exposure to the AI phenomenon.

However, like all groundbreaking innovations, there’s a risk of the market getting ahead of itself. The current valuations of some of these tech behemoths might be factoring in overly optimistic projections about AI’s immediate commercial viability and its short-term revenue-generating potential. While AI’s long-term impact is almost universally acknowledged, its short-term path is rife with uncertainties. Commercializing AI solutions and integrating them seamlessly into diverse sectors might present unforeseen challenges. Regulatory hurdles, ethical considerations, and technical limitations could slow down the rapid pace at which many expect AI to reshape industries.

This potential overvaluation, driven by the AI narrative, creates a precarious situation. If the market begins to perceive that it has been overly exuberant in its expectations, even a slight recalibration in the perceived value of AI could lead to a significant pullback in the tech sector, and by extension, the broader indices that these tech giants dominate. Investors should tread cautiously, distinguishing between genuine technological progress and speculative hype.

Warning Signs

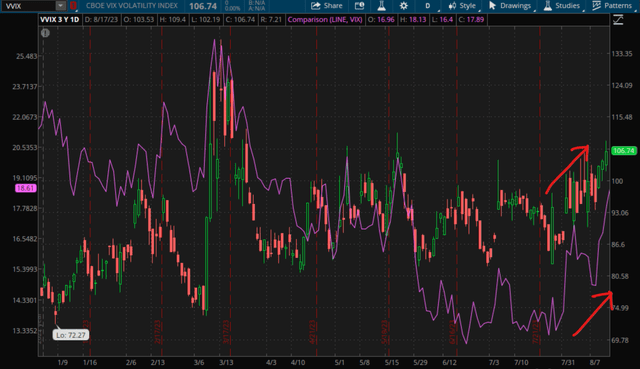

In U.S. equity markets, few indicators capture the pulse of investor sentiment as vividly as the VIX and the VVIX. The VIX measures the market’s expectation of volatility over the next 30 days, drawing a risk neutral model free implied volatility from S&P 500 index options. The VVIX gauges the volatility of the VIX, using a similar computation on VIX index options.

The recent uptrend in both these indices underscores a growing nervousness permeating the market. A rising VIX indicates that traders expect more significant price fluctuations in the near term, potentially heralding a period of increased instability.

VIX and VVIX YTD (ThinkOrSwim)

The uptrend in the VVIX adds another layer of complexity to this narrative. It suggests not just an anticipation of increased volatility but also an uncertainty about the magnitude of that volatility. Think of it as the market signaling a heightened state of unpredictability about its own unpredictability.

In an environment where traders are not only worried about potential downturns but are also unsure about how steep or prolonged such downturns might be, their responses to negative news or economic indicators might be disproportionately defensive, leading to sharper selloffs.

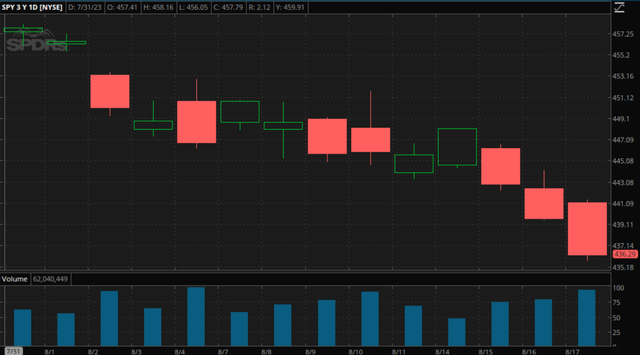

Since August 1, people have been decidedly taking profits. This month has been a steady downtrend, with increasing volume on each down day, and declining volume on each up day (except August 8).

SPY Volume and Price, August (ThinkOrSwim)

The writing is on the wall. There’s no way to know what will happen, but the next leg of the SPY seems to be more and more to the downside. My concern is that sentiment has started to reverse. Investor sentiment was overly bullish at the start of the month, and that is always when things start to turn around.

It’s just that given the backdrop of a market that is pricing in rate cuts, the benefits of AI, and a soft landing, a reversal in sentiment could mean a deep drawdown. As a result, I am issuing a cautionary sell rating on SPY and QQQ.

What to Do?

First, a sell rating on SPY or QQQ should be actioned with bearish derivatives positions, not by selling one’s ETF holdings. This is because the liquidity of SPY and QQQ options is excellent; investors are nearly always paying the best price because the spread is just a cent on most of the options.

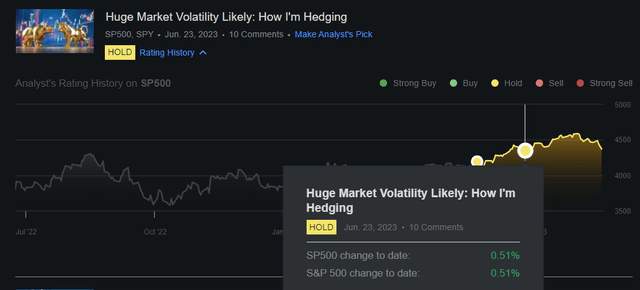

I brought up the need to start hedging back in June. Since then, SPY climbed nearly 5% and then gave up almost all those gains. We are now 0.51% higher from that point. At that time, I was unsure about the direction of future movements – I only thought that a big move was likely in the next few months, so I recommended a strategy of buying SPY strangles and shorting VIX futures to offset the option’s theta decay. Another strategy was buying some VIX calls. Personally, I used a VIX call ratio spread so that the cost of hedge was ~0 for me. More details in the article.

I also mentioned applying a SPY collar or shorting S&P 500 futures to get one’s portfolio closer to delta neutral, though this hedge would probably have lost money because of the ~5% rise in SPY.

Rating History (Seeking Alpha)

Now that there seems to be greater clarity in the next direction of the market, the collar hedge and getting delta neutral with the market makes more sense. It is easy to take chips off the table by adjusting the short call and long put such that the total delta of your hedge can cause your overall portfolio delta to get closer to 0.

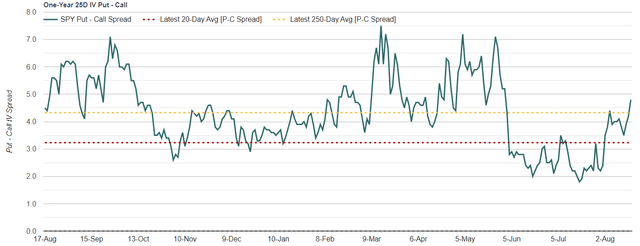

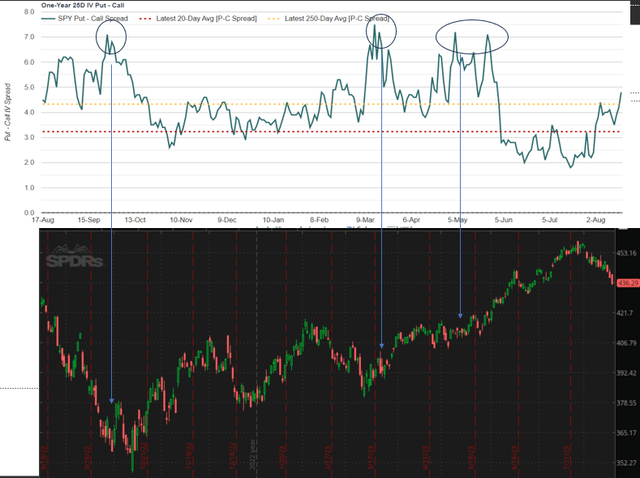

However, given that markets have been spooked, I have put on some other hedges in lieu of my VIX call ratio spreads. Since August, puts have become much more expensive compared to calls, indicating that the volatility skew is steepening. The chart below is the implied volatility (IV) difference between 25-delta puts and calls.

SPY Options Skew (Market Chameleon)

Investors are starting to bid up the price of insurance (puts). Some might be selling calls more aggressively, too. Because the IV skew moves monotonically across strikes, the ATM and NTM puts will be a lot cheaper, in IV terms, than the further OTM puts.

This means a put ratio spread should take advantage of elevated further OTM IV and comparatively lower ATM IV.

The hedge I am doing right now is selling two ~22 delta puts and buying one ~40 delta put. Both are SPY puts, expiring in 42 days. And the trade was established with a credit. You will notice that the net delta, 22+22-40 = 4, is a positive number. So, what is the logic of this hedge? There are four factors:

- Selling high IV and buying low IV is what you want to do with options, in general. The total theta decay of the short puts is nearly twice the theta decay on the long put. The higher IV of the short puts directly cause this.

- Since the skew is steeper than before, this is also a bet on mean reversion of the skew.

- Most importantly, the long put protects you until the underlying falls to the strike price of the short puts. After that point, you might want to start buying the dip, and the second short put’s strike would be the entry point.

- If nothing happens, then you keep the credit to place the trade. Since the total theta will be well in your favor, you can even close the trade early for a profit.

One More Thing

The IV skew is also a good signal for getting back into the market. Generally, people want to buy insurance after the house has started burning. This cannot be done with a house, but it can be done with financial markets – people can keep bidding up puts.

It is when the skew has become extremely steep from put buying that a reversal is usually due. Take a look at the last year. Every peak in the skew has led to a subsequent rally in SPY.

Options Skew and SPY (Market Chameleon; ThinkOrSwim)

When these moments come, it is super profitable to sell OTM puts and buy OTM calls. You profit from the volatility arbitrage between the richly priced put and the cheaply priced call, and benefit when from the positive delta when the market reverses.