The NPPSD Board of Education held its annual budget hearing on Thursday evening. President Angela Blaesi was absent, so Vice President Matt Peterson started the meeting by introducing and turning the hearing over to the district’s Finance Director, Stuart Simpson.

The school board is looking at a $70.4 million budget, an increase of $3.1 million, or 4.62%, more than last year.

The budgeted property tax request will be $2.8 million more than a year ago — a 9.6% increase.

No one from the public spoke at the hearing. The board will vote on the budget at their Sept. 11 regular meeting.

Simpson began by pointing to the Notice of Budget Hearing and Budget Summary that was printed, as required, in a local newspaper. (see below)

Simpson then gave a PowerPoint presentation of the proposed 2023-24 budget. He pointed out the steps that help plan the yearly budget:

• Analyze spending and revenue over the past five years and align with district goals;

• Identify, develop, and analyze additional revenue sources (grants) that would help meet district goals;

• Provide district leaders and principals with current financial information and receive feedback that will help the district make sound financial decisions and improve student achievement;

• Manage the cash reserve for the district to provide three months of expenditures, not to exceed 25% of overall spending.

Simpson noted that budget discussions begin in October of the previous year in the school board’s financial subcommittee and reach the entire board in July.

Simpson said every year he likes to give a brand name to the budget; this year’s brand is “Instructional Transition.”

He described this in four ways:

1) Get your teach on (the teaching and learning department provides professional development opportunities.)

2) Adaptive work for the administrators to help teachers.

3) Curriculum work.

4) Monthly professional development for all teachers.

He also noted that 4.5% of the budget goes toward curriculum/student learning expenses.

The general fund, the special building fund, and the QCPUF Fund (safety in buildings) drive the property tax requests, he said.

In the proposed budget, there is a $1,873,518 increase in general funds from a year ago, a $1,057,578 increase in the special building fund, and a decrease of $734 in the QCPUF Fund.

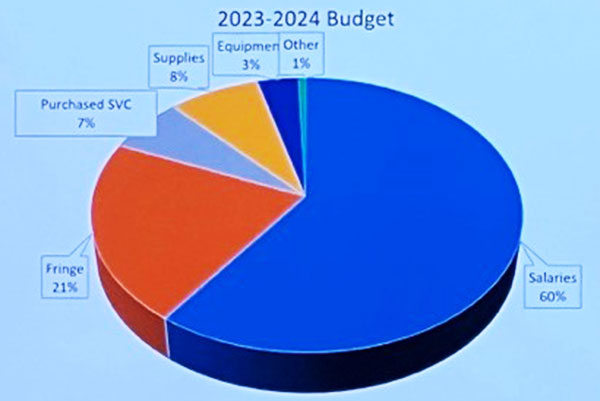

The percentage of the expenses would be: 60% salaries, 21% fringe benefits, 7% purchased services, 8% supplies, 3% supplies, and 1% other.

Simpson said that health insurance cost has gone up 7% in the last year, liability insurance soared 15%, and utility costs increased by 10%, driving the budget higher.

He said the personnel budget comprises 81% of expenditures and falls into three categories — 52% faculty, 44% classified/other, and 4% administration.

He noted that teachers’ and paraprofessionals’ salaries are negotiated with the school board and top administrators.

Board questions:

Skip Altig asked what would happen if the district keeps dipping into the reserves. Simpson said it would lower the percentage held in reserve, and noted that the board adopted a resolution earlier this year allowing access to a line of credit if the district needs to borrow money for a short time.

Altig also said that new legislation hurt the district by reducing some state aid. To that, Simpson clarified, saying that there was a decrease in state aid this year due to an increase in property valuations (resources), a reduction in enrollment (needs), and not being able to increase the poverty allowance (needs), resulting in a $708,000 decrease in state aid.

Emily Garrick asked if the budget included special education funding. Simpson said it does not include the special education state aid, as that comes into play in December.

Altig, who follows the legislature closely, asked if there is a guarantee that the special education money would be $1.9 million. Simpson replied that he did not know the exact amount of state aid for special education and would know that in December, but that it would be 80% of expenditures for special education.

Garrick asked for clarification on the areas of the budget that are increasing. Simpson said the numbers are slightly higher to cover any “in-case” expenditures, and if that results in leftover funds, it would help bring the cash reserves up to 25%. He said he does not want to have to come back to the board and ask to increase the budget authority.

Peterson asked Simpson to go over the areas that are decreasing from the initial budget. Simpson said budgeted expenses were reduced in purchased services and hiring a teacher to cover areas that were previously contracted — ed psych and special ed. The dollar amount of the decrease from initial projections was $439,000.

Peterson also asked for clarification on the issue of the poverty allowance. Simpson stated that due to COVID, parents were not required to fill out paperwork about their incomes that were normally needed to qualify for free meals, so the number of low-income families were unavailable before the state aid was determined for this year.

Simpson did say the numbers will be known in the future but will not help this year.

Garrick asked what expenditures count toward the poverty allowance. Simpson stated that four elementary schools qualified at the poverty level, so all their expenses, para support, safety resource officers, and free breakfasts are eligible expenses. Garrick asked for clarification about where the excess money that was not expended went and Simpson answered that it rolls into the reserves.

(Bulletin Editor George Lauby contributed to this report.)

© 2023 The North Platte Bulletin. All rights reserved.