Wealth protection is crucial to financial planning, especially in today’s unpredictable world. In Arizona, residents can access various strategies and tools that can help protect their assets from potential creditors, litigants, or unforeseen life events. By understanding the importance of asset protection and available resources, you can make informed decisions to securely safeguard your wealth and pass it on to the next generation.

Understanding Arizona’s different asset protection methods can be paramount to maintaining your wealth over time. Some popular methods include estate planning, incorporating businesses, obtaining insurance policies, and setting up trusts. Each method has advantages and nuances, making it essential to seek professional advice and tailor a wealth protection plan that fits your unique circumstances and risk profile.

In addition to these strategies, having a diversified investment portfolio, utilizing financial vehicles like annuities, and understanding the specific needs of your profession can help bolster your wealth protection toolkit. Partnering with experienced legal practitioners to navigate these strategies will provide the knowledge and expertise needed to help ensure long-term financial stability.

Key Takeaways

- Wealth protection in Arizona involves various strategies and tools to safeguard assets from creditors, litigants, or unexpected life events.

- Popular asset protection methods include estate planning, incorporating businesses, obtaining insurance policies, and setting up trusts.

- Diversification, financial vehicles like annuities, and understanding the specific needs of your profession contribute to a robust wealth protection plan.

Understanding Wealth Protection in Arizona

Wealth protection in Arizona is essential for ensuring your financial independence and securing the legacy you leave to your heirs. It protects your wealth against potential threats like creditors, lawsuits, and taxes. As you navigate the Arizona landscape, it’s important to recognize the interplay between wealth protection, financial planning, and asset management.

In Arizona, incorporating a proactive strategy for asset protection can make a significant difference in preserving your wealth. This might include employing proper insurance coverage, understanding tax implications, and working with experienced professionals. Consulting with a wealth protection and growth specialist can help you identify tax planning strategies to minimize liability and create a comprehensive estate plan tailored to your situation.

One crucial aspect of wealth protection in Arizona is finding the right attorney. A knowledgeable asset protection attorney can guide you through the local legal process and advise you on resources tailored to Arizona’s unique laws. This expertise can be vital for personal or business asset protection.

Maintaining an up-to-date understanding of matters like Arizona’s Lis Pendens, a legal notice related to pending lawsuits involving properties, can directly influence the security of your real estate investments. Being aware of the possible impact of Lis Pendens on your titles and transactions ensures that your assets remain well-protected.

Remember, preserving wealth in Arizona goes beyond immediate asset protection. It also helps secure your financial independence, enabling you to maintain a high quality of life. By taking proactive steps, you can achieve a robust safeguarding strategy, strengthening your position in the competitive world of wealth management.

The Importance of Asset Protection

Protecting your assets is crucial in today’s unpredictable world. You may face risks such as lawsuits and unexpected life events as you accumulate wealth. By taking proactive measures and incorporating asset protection into your financial plans, you ensure the security of your hard-earned wealth.

Assets include personal property, cash, bonds, stocks, real estate, and other valuables. Proper asset protection strategies can help safeguard these assets against creditors and potential litigants who may have claims against your wealth. Partnering with a financial professional can help you set up these strategies effectively.

Trusts serve as one widely used vehicle for asset protection. Trusts allow you to legally transfer the ownership and control of your assets to a trustee while still providing you access to the benefits they bring. A properly structured trust ensures that your assets remain intact and secure for the benefit of your intended beneficiaries.

Asset protection trusts, in particular, offer robust protection for your wealth. These specialized trusts shield your assets from creditors and other potential risks. Transferring your assets into an asset protection trust creates a legal barrier that insulates them from adverse claims.

In Arizona, residents qualify for various asset protection exemptions. These are codified by statute and offer automatic protection for certain assets, such as the first $400,000 of equity in a personal residence and the investment component of life insurance policies and annuity contracts.

Remember, planning and taking a proactive approach is key to effective asset protection. Consult with a financial professional to determine the most suitable strategies for your situation and ensure your assets remain secure for years.

Estate Planning Essentials

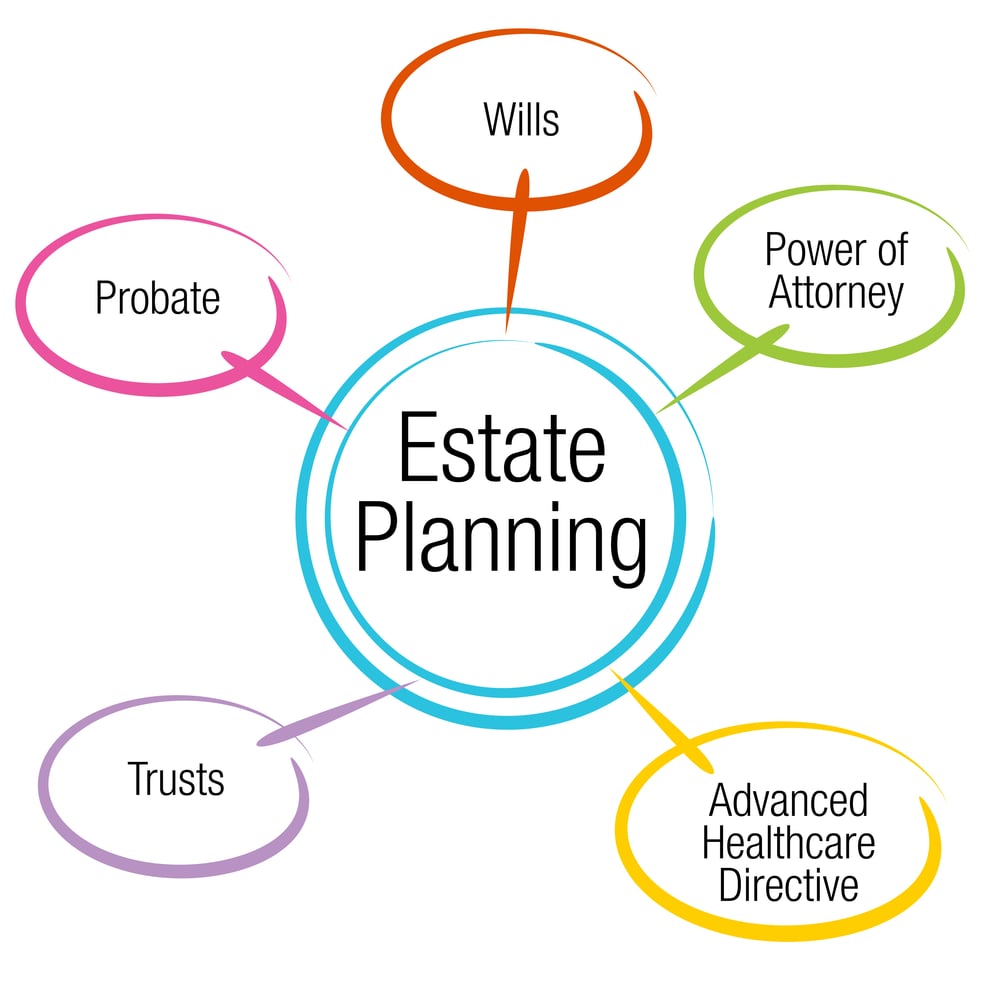

Estate planning is an essential component of wealth protection in Arizona. Creating a comprehensive estate plan can help protect your assets and ensure they pass to your heirs according to your wishes. Not only does this provide peace of mind, but it can also help avoid unnecessary taxes and legal issues.

The first step in estate planning is to assess your assets thoroughly. This will provide a clear picture of what you have and allow you to make informed decisions about how to protect your wealth for future generations. It’s essential to consider all your assets, including properties, investments, and businesses.

Wills are a fundamental part of estate planning, enabling you to outline your wishes for how your assets should be distributed after your passing. Having a will in place can minimize the risk of disputes and legal battles among your heirs. A well-crafted will also allow appointing an executor to manage your estate during the probate process.

Trusts play a significant role in Arizona estate planning, offering flexibility and control over the management and distribution of your assets. Trusts can also provide tax benefits and help safeguard your wealth from potential creditors. Furthermore, trusts often allow your heirs to avoid the lengthy probate process, granting them more immediate access to their inheritance.

Alongside wills and trusts, consider implementing other estate planning tools such as powers of attorney, health care directives, and beneficiary designations on retirement accounts and life insurance policies. These additional measures can provide added protection for your assets and ensure that your wishes are fulfilled in the event of incapacity.

In conclusion, Arizona estate planning is crucial to wealth protection and preserving your legacy for generations. Taking the time now to create a thorough and well-considered estate plan will provide peace of mind for you and your heirs in the future.

Insurance for a Protected Life

Protecting your wealth in Arizona starts with a solid insurance plan. By carefully choosing the right life insurance policies and long-term care insurance, you can secure your financial future and protect your loved ones.

Life insurance policies play a crucial role in wealth protection strategies. There are various life insurance policies, such as term and permanent life insurance. It would help to consider policy premiums, coverage, and potential cash value before selecting the most suitable policy. Arizona residents can also take advantage of irrevocable life insurance trusts (ILITs) to protect and control their insurance policies while still alive. ILITs provide tax-free death benefits and safeguard the insurance policy from creditors and divorce.

Long-term care insurance is another essential component for wealth protection in Arizona. This type of insurance covers the costs of care services required as you age, such as assisted living, nursing homes, or in-home care. Investing in long-term care insurance can help protect your assets from being depleted by costly long-term care expenses, giving you and your family peace of mind.

When selecting insurance policies, you should compare policy terms, premiums, and coverage to find the right options. Also, consider discussing your particular needs with a wealth protection professional to guide you.

Securing your financial future in Arizona involves a strategic approach to insurance planning. Investing in the right life insurance policies and long-term care insurance ensures your wealth is protected, allowing you to enjoy the fruits of your hard work.

Forming Your LLC for Wealth Protection

As a business owner, entrepreneur, or family business owner in Arizona, protecting your wealth should be one of your top priorities. One way to achieve this is by forming a limited liability company (LLC). An LLC can offer you asset protection and help ensure the longevity of your business.

When you form an LLC, it separates your assets from the company’s. If your business encounters any financial troubles, your assets, such as your home, car, and bank accounts, will remain protected. Additionally, this separation of assets can help ease your family’s financial planning burden.

To establish an LLC in Arizona, you must first choose a unique name for your company. It must be different from any other existing businesses registered in the state. Next, you’ll need to designate a statutory agent, someone responsible for receiving official correspondence on behalf of the company. Make sure the agent is an Arizona resident or a business authorized to conduct business in the state.

Once you’ve completed these preliminary steps, you can file your Articles of Organization form with the Arizona Corporation Commission by mail or online. Be sure to include your LLC’s name, address, statutory agent information, and details about company management.

An important aspect of forming an LLC involves deciding on its management structure. You can designate members with a financial stake in the company, managers who oversee operations, or even a single-member LLC. Consider your business goals and which structure best aligns with them.

After your LLC has been successfully registered, you may need to obtain any necessary licenses or permits, depending on your goods or services. Applying for an Employer Identification Number (EIN) is essential to hire employees or open a business bank account.

Remember, a well-structured LLC can help safeguard your assets and ensure the success of your business in Arizona. By taking these measures, you can focus on growing your enterprise while enjoying financial security.

Avoiding Probate and Unexpected Expenses

Probate can be lengthy and costly, but fortunately, there are ways to avoid it and the unexpected expenses that come with it. As a resident of Arizona, you have several options to protect your wealth and make the distribution of your assets smoother for your loved ones.

One of the most common ways to avoid probate in Arizona is by creating a revocable living trust. This legal arrangement lets you transfer your assets into a trust, with you as the initial trustee, allowing you to maintain control over your assets during your lifetime. After your death, a designated successor trustee distributes the assets according to your wishes. Trusts help you avoid probate and offer privacy and potential tax benefits.

When planning your estate, consider joint ownership with the right of survivorship. This strategy involves jointly holding assets, such as real estate and bank accounts, with a co-owner. Upon your death, ownership automatically transfers to the surviving co-owner, bypassing the probate process.

Another way to keep your assets from going through probate is by designating beneficiary accounts or transfer-on-death (TOD) arrangements for bank accounts, retirement accounts, and other investments. Naming beneficiaries allows these assets to pass directly to your chosen individuals without court involvement.

Be mindful of gifts and lifetime transfers as well. You can give assets as gifts during your lifetime to avoid them being subject to probate after your death. However, remember that there may be tax implications depending on the size and nature of the gifts.

By carefully planning your estate using these strategies, you can minimize or even avoid probate altogether, saving your loved ones time, stress, and money. Remember, it’s essential to consult an experienced estate planning attorney to help tailor a plan specific to your circumstances and ensure your assets are protected according to Arizona laws.

Safeguarding Assets from Creditors

Protecting your wealth from potential creditors can be essential to asset protection planning in Arizona. Taking action and implementing strategies before claims arise is important to keep your assets safe. Here are some ways to shield your assets from creditors in Arizona.

Homestead Exemption: One of the fundamental protections offered by Arizona law is the homestead exemption. As a homeowner, you can safeguard a certain amount of equity in your primary residence from creditors. Understanding and utilizing this exemption can help preserve your home and maintain a haven for you and your loved ones.

Insurance Policies: Maintaining appropriate property and liability insurance is another crucial aspect of asset protection. Insurance plans play a significant role in protecting your assets from potential claims. Make sure that your policies have adequate coverage and are up-to-date.

Asset Protection Exemptions: Arizona law provides several asset protection exemptions, which protect various assets from most creditors after a judgment or bankruptcy filing. Fostering awareness of these exemptions can help fortify your overall asset protection strategy.

Irrevocable Trusts: Transferring your assets into an irrevocable trust can help protect them from creditors. These trusts remove the assets from your taxable estate, potentially reducing estate taxes. Further, the assets in irrevocable trusts are sheltered from creditor claims and lawsuits, ensuring your intended beneficiaries receive their share.

In summary, to safeguard your assets from creditors in Arizona, it’s crucial to take advantage of the homestead exemption, maintain property and liability insurance, understand the benefits of asset protection exemptions, and consider using irrevocable trusts. By integrating these strategies into your asset protection planning, you can secure your wealth and provide peace of mind for yourself and your loved ones.

Preserving Wealth for the Next Generation

Preserving Wealth for the Next Generation

Preserving wealth for the next generation should be a top priority when planning your financial future. The key to successful wealth preservation lies in a combination of thoughtful strategies, ensuring your family’s legacy remains secure and financially sound.

To begin, create a comprehensive estate plan. This plan should address not only the distribution of your assets but also the designation of decision-makers for your medical and financial affairs. A well-crafted estate plan minimizes the potential for disputes and ensures that your wishes are fulfilled.

Consider tax-efficient strategies for transferring wealth to your heirs. Various options, like trusts, can help reduce the next generation’s tax burden. Consulting with a financial planner can help you navigate the complexities of tax laws in Arizona and create a plan tailored for your family’s needs.

Invest in diverse assets like stocks, bonds, and real estate. By spreading your wealth across various assets, you reduce the risk of loss should a particular investment decline in value. A balanced and diversified portfolio also increases the likelihood of long-term growth, benefiting your heirs.

Prioritize the protection of your assets by considering insurance policies and legal structures that can shield your wealth from potential lawsuits or liabilities. In Arizona, establishing a limited liability company (LLC) or using an irrevocable trust can provide additional protection for your valuable assets.

Finally, educate the next generation on wealth preservation, financial literacy, and responsible money management. By sharing your experience and knowledge, you empower your successors to make informed decisions, safeguarding the family legacy for years.

By taking these steps and working alongside financial professionals, you can successfully preserve your wealth for the next generation, ensuring your family’s financial future remains safe and secure.

Role of Legal Practitioners in Wealth Protection

As you explore wealth protection strategies in Arizona, it’s essential to understand legal practitioners’ role in this process. Law firms and attorneys specializing in asset protection and wealth management can be your trusted allies, guiding you through various legal structures and methods tailored to meet your needs.

Best attorneys of America and highly recognized lawyers of distinction are well-versed in crafting personalized wealth protection plans for their clients. They possess the necessary expertise to identify potential risks and implement measures to safeguard your assets from threats such as legal claims, taxes, and probate.

In Arizona, a legal practice focusing on wealth protection typically offers comprehensive services in areas such as estate planning, asset protection planning, and business planning. These services are designed to provide cost-effective, safe, and predictable systems to manage and pass on your wealth.

Legal practitioners can help you:

- Create structures within which you can safely accumulate additional assets and from which those assets can be reinvested.

- Identify and eliminate or control risks that can impact your wealth.

- Advise on strategies to minimize tax liabilities and address probate-related concerns.

Moreover, experienced wealth protection attorneys continuously update their knowledge of any changes in the legal landscape, ensuring that your wealth protection plan remains effective and compliant with current laws.

Engaging in open and transparent communication is critical when working with a law firm or attorney. Share your goals, concerns, and expectations with your legal practitioner, as this will enable them to provide you with the best possible advice and guidance.

So, as you embark on your journey of wealth protection in Arizona, remember that partnering with a skilled legal practitioner is vital for success. Their expertise and guidance are invaluable in securing your financial future and providing peace of mind for yourself and your loved ones.

Diversifying Investments for Protection

In Arizona, it’s important to consider diversifying your investments to protect your wealth better. By spreading your funds across various assets, like stocks, bonds, and real estate, you can reduce the overall risk to your portfolio and increase the growth potential.

One key approach to diversifying your investments is to consider allocating funds to various industries and asset classes. This way, if one sector experiences a downturn, the impact on your overall portfolio will be minimized. For instance, you could invest in technology, healthcare, and renewable energy sectors, offering unique growth opportunities and market trends.

Additionally, keep a close eye on market volatility and adjust your portfolio as needed. A balanced mix of intangible, tangible, and alternative investments can help. Some examples include:

- Intangible investments: stocks, bonds, and cash

- Tangible investments: real estate, gold, and commodities

- Alternative investments: hedge funds, private equity, and collectibles

Another valuable strategy is to reassess and rebalance your portfolio periodically. Market fluctuations can change the weighting of your different investments over time. Regularly evaluating and adjusting your portfolio will ensure it stays aligned with your risk tolerance and financial goals.

Lastly, don’t forget to consider tax implications when diversifying your investments. In some cases, selecting certain asset types or strategies can provide tax benefits, such as deferral capital gains taxes or potential tax credits. Consult with a financial professional to help you navigate the tax implications and create a diversified portfolio that best suits your needs.

By implementing these strategies, you can build a diversified investment portfolio in Arizona that is well-equipped to withstand market fluctuations and better protect your wealth.

Financial Protection with Annuities

Regarding wealth protection in Arizona, annuities can be a valuable addition to your financial plan. By investing in annuities, you’re safeguarding your retirement savings and creating an additional source of income during your golden years. You can consider different types of annuities, such as fixed-indexed annuities, which offer you more potential for growth while still providing protection.

A fixed-indexed annuity provides a unique combination of potential growth and protection. Your investment is tied to a market index, such as the S&P 500, allowing you to enjoy the potential for higher returns when the index performs well. However, even when the index underperforms, you still benefit from a safety net of guaranteed interest, ensuring your principal is protected.

Thanks to state guaranty associations, you’re also protected from annuity insurers’ insolvency in Arizona. In the unlikely event of your annuity provider facing financial hardship, your investment is still safe up to a certain limit, currently $250,000. This gives you added peace of mind when investing in annuities as part of your wealth protection plan.

Considering the various exemptions and tax benefits associated with annuities adds to their appeal. For instance, Arizona has an exemption of $150,000 for the household and a safe vehicle exemption of $6,000. Furthermore, the capital gains tax rate in the state is at 4.50%. These factors make annuities an attractive option in your wealth protection journey.

To summarize, if you’re looking for a financial tool that offers growth potential, wealth protection, and retirement income, annuities might be the right choice for you here in Arizona. Whether you’re interested in fixed indexed annuities or other types, taking the time to research and understand the benefits will help ensure your financial well-being during your retirement years.

Needs of Specific Professions

As a professional living in Arizona, you may have unique wealth protection needs depending on your line of work. Different professions face different risks and require tailored strategies for protecting their assets. Let’s look at the wealth protection needs of executives, physicians, professional athletes, and individual clients with specific circumstances.

Executives often have complex financial portfolios of stocks, options, and other securities. You may be exposed to both personal and professional liability risks. To protect your assets, consider diversifying your investments, holding assets in trusts, and working with an attorney specializing in asset protection for executives.

Physicians face unique risks due to the nature of their profession. Malpractice suits and other legal issues can put your assets at risk. You might want to explore setting up a professional corporation or limited liability company to protect your assets better. Also, consider various strategies for separating your personal and professional assets and obtaining appropriate liability insurance coverage.

Professional athletes often have short, high-earning careers and unique wealth management challenges. As an athlete, your financial security relies on your ability to earn income in a limited timeframe. Protect your wealth by working with professionals experienced in athlete asset protection, and consider diverse investment strategies to create a stable foundation for your future financial needs.

Finally, individual needs vary greatly, and each person may require a customized approach to wealth protection depending on factors such as family dynamics, estate planning goals, and business interests. Working with experienced professionals who understand Arizona’s wealth protection laws and strategies will help you tailor a plan to your unique needs, ensuring your assets are protected now and in the future.

Trusting in Trusts

Regarding wealth protection in Arizona, you might want to consider the advantages of establishing various types of trusts. Trusts offer security for your assets, ensuring they are managed according to your wishes and efficiently transferred to your loved ones.

One popular type of trust in Arizona is the revocable living trust. This trust allows you flexibility and control; you can change or revoke it anytime. By placing your assets in a revocable trust, you avoid probate, which can save time, money, and emotional strain for your family. Additionally, as a trustee, you maintain control over your assets and can name a successor trustee to manage the trust in case you become incapacitated or pass away.

Conversely, an irrevocable trust is another option that, once created, cannot be altered or revoked. This type of trust can provide a higher level of asset protection, as it separates your assets from your estate, making it difficult for creditors or litigants to access them. Further, an irrevocable trust can minimize estate taxes and protect your beneficiaries from creditors.

While Arizona does not currently permit self-settled asset protection trusts like some other states, it is important to know the various types of trusts and understand their implications for your financial planning.

Here are some key points to keep in mind when considering trusts for wealth protection:

- Appoint a trustworthy and competent trustee who will act in your best interests and follow your instructions.

- Understand the differences between revocable and irrevocable trusts concerning control, flexibility, and asset protection.

- Consult with an experienced estate planning attorney who can guide you through establishing and managing trusts, ensuring compliance with Arizona trust laws.

Remember, wealth protection is not a one-size-fits-all solution. By carefully considering the benefits and limitations of different trusts, you can create a personalized strategy that helps safeguard your assets and provides peace of mind for you and your family.

Advertisement

Ask a Legal Question, and Get an Answer ASAP!

Frequently Asked Questions

How does Arizona safeguard assets in lawsuits?

Arizona offers various asset protection measures to help safeguard your wealth in case of a lawsuit. For instance, the household exemption in Arizona is $150,000, which means that your family’s residence is protected up to this amount. A safe vehicle exemption is $6,000 ($12,000 for disabled or elderly debtors and their spouses).

Can domestic asset protection trusts be used in Arizona?

Yes, domestic asset protection trusts (DAPTs) can be utilized in Arizona. They provide additional protection for your assets against lawsuits and claims. Transferring your assets to a DAPT can shield them from potential creditors while maintaining control over the trust’s assets and decisions.

Which Arizona laws focus on wealth security?

Various Arizona laws focus on wealth security, such as estate planning laws, mechanisms for avoiding probate, exemptions for homes and vehicles, and the allowance of domestic asset protection trusts. The combination of these laws supports the preservation of your wealth and helps protect it from potential lawsuits and creditors.

What strategies can help protect assets in Arizona?

Some strategies to help protect assets in Arizona include setting up a living trust, utilizing domestic asset protection trusts, employing LLCs or partnerships to protect business assets, and taking advantage of exemptions for homes and vehicles. Regularly consulting with an asset protection attorney or sudden wealth attorney can help you stay informed about the most effective strategies for safeguarding your wealth in Arizona.

How do sudden wealth attorneys assist in Arizona?

Sudden wealth attorneys in Arizona play a crucial role in protecting your assets in case you acquire a large sum of money suddenly, such as from an inheritance, winning the lottery, or a successful business endeavor. They guide you through properly managing your newfound wealth, creating a comprehensive estate plan, setting up trusts, and taking advantage of legal protections to secure your financial future.

Do other states provide better asset protection than Arizona?

Some states may have stronger asset protection laws than Arizona. However, it’s essential to consider your unique situation and needs when deciding which state offers the best asset protection for you. Consulting with an attorney can help you understand the comparative advantages of different jurisdictions and decide which state provides the most appropriate wealth protection measures for your specific circumstances.

Images: DepositPhotos