On September 7, 2023, it was reported that Mirabella Financial Services LLP had acquired a new position in Radian Group Inc. (NYSE:RDN) during the first quarter of the year. The purchase consisted of 9,558 shares of the insurance provider’s stock, with an approximate value of $211,000.

Radian Group recently released its quarterly earnings data on August 2nd. The company reported earnings per share (EPS) of $0.91 for the quarter, surpassing the consensus estimate by $0.15. During this period, Radian Group generated revenue amounting to $278.85 million, slightly below the consensus estimate of $289.10 million. It is noteworthy that Radian Group achieved a return on equity of 17.30% and boasted a net margin of 54.83%.

Looking ahead to the company’s future performance, sell-side analysts anticipate that Radian Group Inc. will post an EPS of 3.47 for the current fiscal year.

Mirabella Financial Services LLP’s purchase of shares in Radian Group Inc. indicates confidence in the prospects and potential growth opportunities offered by the insurance provider.

The addition of these shares to Mirabella Financial Services LLP’s investment portfolio speaks to their assessment of Radian Group’s financial stability and market positioning within the insurance industry.

As always, prudent investors should conduct their own research and analysis before making any investment decisions based on third-party reports or filings such as those provided by Mirabella Financial Services LLP and other similar institutions.

It is important to note that investments in stocks carry inherent risks and may result in losses. It is advisable for investors to consult with financial professionals before engaging in any investment activities.

Investors are encouraged to stay informed about updates regarding Radian Group Inc., particularly any further developments related to its financial performance or significant events that may impact its stock value.

This article serves as an informational piece and should not be considered financial advice.

Radian Group Inc.

RDN

Buy

Updated on: 08/09/2023

Major Investors Show Growing Interest in Radian Group Inc. Amidst Changing Market Conditions

In the ever-evolving world of finance, it is common to witness large investors making significant changes to their positions in various companies. One such company is Radian Group Inc. (RDN), a prominent insurance provider that has recently attracted the attention of several major investors.

Goldman Sachs Group Inc., for instance, substantially increased its stake in Radian Group during the second quarter of this year. The investment firm now owns an impressive 3,295,712 shares of the company’s stock, a stake valued at $64.76 million. This increase in ownership represents a staggering 202.0% growth, as Goldman Sachs acquired an additional 2,204,335 shares during this period.

Charles Schwab Investment Management Inc., another well-known player in the financial sector, also decided to enhance its position in Radian Group. Their ownership of the insurance provider’s shares expanded by 61.7% during the first quarter, as they accumulated an additional 1,523,376 shares. In total, Charles Schwab Investment Management Inc. now possesses 3,994,265 shares worth $88.71 million.

Vanguard Group Inc., one of the most influential companies within the investment management industry today, didn’t shy away from investing further in Radian Group either. They raised their stake by 8.5% during the first quarter and currently own a substantial number of shares – precisely 18,357,109 – valued at $407.71 million.

Fuller & Thaler Asset Management Inc., recognized for their expertise and success in asset management strategies and quantitative research analysis techniques, chose to uplift their position in Radian Group as well. Their holdings surged by 49.1% during the fourth quarter last year and now amount to an impressive 4,119,242 shares valued at $78.55 million.

Lastly but certainly not least important is Principal Financial Group Inc., which opted to boost its stake in Radian Group by a mind-boggling 9,190.1% during the first quarter. The company currently holds 949,446 shares worth $20.98 million.

All these investments made by institutional investors and hedge funds have not gone unnoticed. Analysts from various research firms have weighed in on Radian Group’s performance, providing valuable insights into the company’s current standing.

Keefe, Bruyette & Woods recently downgraded their rating of Radian Group from “outperform” to “market perform.” They also set a price objective of $27.50 for the insurance provider’s stock.

StockNews.com initiated coverage of Radian Group and assigned a “hold” rating to the stock.

On the other hand, Royal Bank of Canada raised their price target for Radian Group from $26.00 to $29.00 and rated the company as “sector perform.”

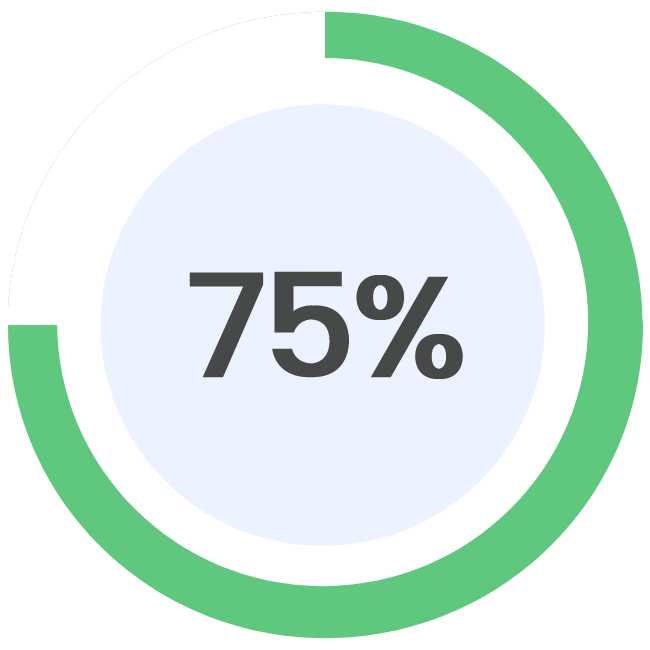

With one sell rating, five hold ratings, and two buy ratings assigned to Radian Group by research analysts, it is evident that there are varying opinions about the company’s future prospects. Bloomberg reports that the consensus rating for RDN is currently labeled as “Hold,” with a corresponding consensus target price of $25.67.

In recent news related to Radian Group, Director Gregory Serio sold 3,800 shares of the company’s stock on August 17th at an average price of $26.82 per share. This transaction amounted to a total of $101,916.00 in sales proceeds for Serio. Following this sale, Serio now holds 8,221 shares valued at approximately $220,487.

It is important to note that corporate insiders currently own 1.58% of the company’s stock.

As for Radian Group itself, its shares opened at $26.37 on September 7th. The market capitalization of the company stands at an impressive $4.15 billion, reflecting its significance within the industry. The price-earnings ratio of Radian Group is 6.43, indicating potential value in relation to its earnings. Additionally, the company has a PEG ratio of 1.53, providing further insight into its growth potential.

With a beta of 1.08, Radian Group demonstrates a moderate degree of volatility in comparison to the market as a whole. Over the past year, the company’s share price has fluctuated between $17.83 and $28.26, showcasing both lows and highs during this timeframe.

Radian Group’s performance can also be analyzed through its moving averages. The company’s 50-day simple moving average currently stands at $26.58, while its 200-day simple moving average is slightly lower at $24.63.

Establishing itself as a notable player within the insurance sector, Radian Group has a debt-to-equity ratio of 0.38, indicating prudent financial management practices by the company’s management team.

As investors continue to monitor RDN and navigate through changing market conditions and research analyses, they should remain cognizant of these factors while determining their investment strategies based on their individual goals and risk profiles.