To print this article, all you need is to be registered or login on Mondaq.com.

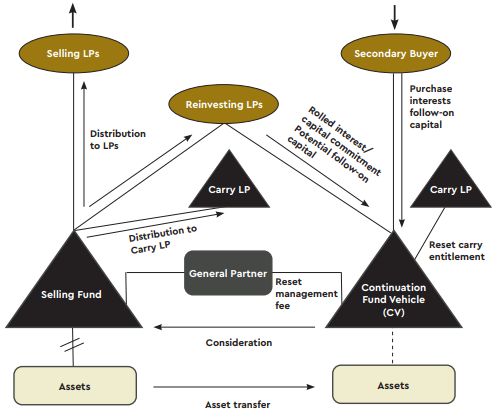

A vehicle capitalised by a secondary buyer and managed by the

existing GP acquires one or more assets from the existing

fund.

Summary

Why use a Continuation Vehicle?

- Maintain exposure to high-performing assets or maximise returns

on underperforming assets. - Extend the hold period for assets while raising significant

further follow-on capital to enhance returns.

What is the process?

- Principal secondary buyer becomes lead investor in continuation

vehicle. - Existing LP base offered the option to sell or to

‘roll’ into the continuation fund. - New carry arrangements may be established to align interests of

secondary buyer, GP and electing LP.

Key considerations

Conflicts of interest

- Managing actual/potential conflicts of interest is fundamental

– this includes articulating the commercial rationale,

implementing appropriate structuring, generating arm’s

length/fair pricing, ensuring transparency via

disclosure/communication in selling fund and underpinning future

alignment with robust CV economics. - LP engagement will be needed, the LPAC may need to approve any

conflict.

Key documentation

- Buyer LPA.

- Election Memorandum.

- Framework Agreement.

- Equity Commitment Letter (if not included in the Framework

Agreement). - SPA(s).

Election process

- Election to sell or “roll” may also include an option

to increase a rolling LP’s commitment in the CV - Election process timeline varies but ILPA suggests 20 BDs. That

said, further ILPA guidance on CV processes is expected imminently

and so this recommended timeframe may change in coming months. - Lead investors may require minimum/maximum participation. Thus,

LP participation may be subject to deductions, adjustments, scale

ups and/or scale backs.

Conditionality

- Closing conditions may include: LPAC consent, LP election

participation, or other third-party consents (e.g., FDI, merger

control/anti-trust, national security, financing, underlying

portfolio management etc.).

Liability

- Warranties will be given by the selling fund, its GP and the

CV. Depending on the deal dynamic, warranties may be given by

management of the underlying portfolio. - Warranty scope varies depending on the underlying portfolio.

Historically, CV deals were warranty- lite but the scope of

warranties typically extends as the transaction becomes more

concentrated (i.e., single asset CVs are more akin to traditional

M&A). - W&I insurance is a standard tool to manage transaction

liability.

CV economics

- Key to generating day 1/future alignment.

- Management fees typically lower than on main vintages of fund

depending on target asset(s) (ILPA recommends

proportionality). - Carried interest may be layered/ratcheted to drive high

returns. - A high proportion of (and sometimes all) sell-side crystalised

carried interest is typically reinvested. - GP commit/co-invests from flagship vintages are commonly used

to improve skin in the game/ demonstrate conviction in the business

plan.

Our secondaries platform

Travers Smith has extensive experience in complex private

markets transactions, with a focus on liquidity solutions across

the private markets capital structure with exposure across all

asset classes.

Originally published by 11 May, 2023

The content of this article is intended to provide a general

guide to the subject matter. Specialist advice should be sought

about your specific circumstances.

POPULAR ARTICLES ON: Corporate/Commercial Law from UK

Shepherd and Wedderburn LLP

When negotiating a contract, it is important to distinguish between statements that are ‘pre-contractual’ and made as part of negotiations, and those that are intended to be contractual terms.

Shepherd and Wedderburn LLP

Breaches of contract occur when there is some form of non-performance of a contractual obligation. Before responding to a breach of a contract, an aggrieved party must determine…

Shepherd and Wedderburn LLP

The key to forming a valid and enforceable contract is to ensure that there is clarity and mutual agreement at every stage of the process…

Penningtons Solicitors LLP

Artificial intelligence (AI) is transforming the way that we live and work. As AI changes how businesses operate, supply services and work with customers and clients, the contracts that govern…

Shepherd and Wedderburn LLP

Warranties and indemnities are contractual clauses that provide protection to buyers. In a typical sale and purchase agreement, it is the buyer who bears…