Feverpitched

Last week, I posted an article that explained why I stopped buying rental properties to buy REIT (VNQ) instead.

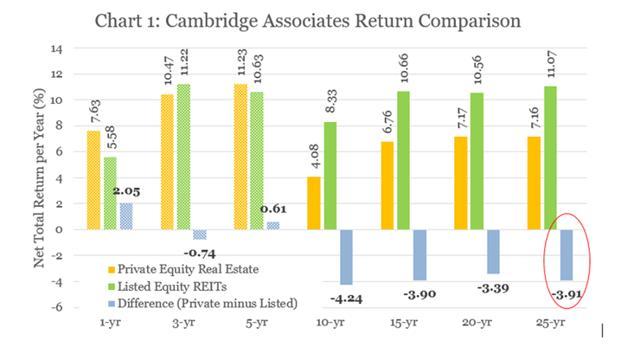

In short, I argued that REITs offer better returns with lower risk and less effort in most cases.

- The higher returns are the result of economies of scale, stronger bargaining power with tenants, the ability to develop assets, superior access to capital, better talent, and many other reasons. Realty Income (O), Public Storage (PSA), American Tower (AMT), and others have compounded returns at 15% per year on average over the long run.

- The risks are much lower because REITs are public, liquid, diversified, professionally managed, moderately leveraged investments with limited liability and no social aspect.

- And they require less effort because they are completely passive and only require occasional monitoring of quarterly results.

Cambridge

But not all of you seemed to agree with me.

The comment section was very lively with lots of discussions about the pros and cons of REITs vs. rental properties and many of you seemed to think that rentals are better investments because:

- You cannot use leverage when buying REITs

- REITs are less tax-efficient

- And so their returns should be far lower when adjusted for that

I decided to write a follow-up article because I think that these are all misconceptions. They’re hurting the quality of the debate so let’s correct them once and for all:

Misconception #1: “You cannot use leverage when buying REITs”

This is the biggest misconception.

People assume that REITs must be worse investments because you cannot take a mortgage to invest in REITs like you would when buying a rental property.

But what they ignore is that REITs already are leveraged investments. When you buy shares of a REIT, you are providing the equity to the REIT, the equivalent of a downpayment.

REITs then take this equity and add debt on top of it to leverage it. Therefore, your equity enjoys the exact same benefits of leverage that you would if you were buying a rental property.

What seems to confuse many of you is that what you see traded on the stock market is the equity value, not the total asset value.

So your $40,000 investment in shares of REITs may correspond to a $100,000 real estate investment. You will only see the value of your equity traded on the public market, but you will indirectly control much more real estate.

But the leverage of REITs is even better. They’re safer because you won’t have to sign on any of the loans and enjoy limited liability. Then on top of that, this leverage also may be more rewarding because REITs will often get preferential terms with lower rates, interest-only periods, etc. That’s normal given that they are much safer borrowers than individual investors.

Misconception #2: “REITs are not tax-efficient”

That’s another major misconception.

People will claim that REIT dividend payments are taxed as ordinary income and therefore, they are not tax-efficient.

But here’s why this is shortsighted.

Firstly, REITs only pay out a portion of their cash flow in dividends, and whatever they retain is fully tax deferred. The 90% payout rule is based on taxable income, but the cash flow is typically a lot higher due to non-cash depreciation. As a result, a lot of REITs will only distribute about 50%-60% of their cash flow in the form of dividends. That other 50% is taxed at 0% since it’s retained by the REIT and reinvested in growth.

Secondly, a portion of the dividend payment is often classified as “return of capital.” Once more, this is fully tax deferred. Some REITs even classify 100% of their distributions as return of capital so you owe no taxes. BSR REIT (OTCPK:BSRTF) is a good example of that.

Thirdly, whatever portion of the dividend is taxed will also benefit from a 20% deduction, reducing the taxes even further.

Fourth, REITs typically generate a large portion of their returns from growth and appreciation. REITs enjoy greater growth prospects than rentals because they typically invest in Class A properties and have access to public capital markets to raise additional capital for growth.

Fifth, REITs are today heavily discounted relative to their net asset values, and therefore, the future returns will likely be heavily dominated by appreciation, which is tax deferred. The dividend income is just a bonus on top of that.

And finally, if that’s not tax-efficient enough for you, you could of course also hold your REITs in a tax-deferred account to defer all of it.

The takeaway here is that REITs are very tax-efficient. In fact, I pay less taxes investing in REITs than rentals when you take all of this into account.

I would add that the tax benefits of rentals also lead to significant indirect costs down the line. You can depreciate your property to reduce today’s tax liability, but this also means that you will be hit with a huge tax bill if you sell your property in the future. As a result, a lot of rental property investors end up stuck with real estate forever and won’t be able to get out of the market even if real estate becomes overpriced and unappealing. That has a significant indirect cost. With REITs, you can be more agile and get out of them if and when they become pricey.

Misconception #3: “I can earn 20%-30% annual returns with rentals!”

Then a final misconception that I see often in comment sections is that rental property investors will claim that they earn 20%, 25%, or even 30% annual returns by investing in rentals.

In reality, their math is wrong and their returns are a lot lower in most cases.

Warren Buffett became the richest investor on earth by compounding investor’s capital at Berkshire Hathaway (BRK.A) (BRK.B) at 20% per year over the long run so I can guarantee you that rental property investors are not just casually earning 30% per year by doing this as a side hobby. Otherwise, we would have a lot more rental property billionaires.

The reality is that rental properties are a low margin, capital-intensive business with low barriers to entry. If there were such high returns to be earned, the competition would be far greater.

Rental property investors who think that they earn such high returns will typically make two mistakes in their calculations.

Firstly, they will not account for the value of your time and work. They will spend countless hours working on their rental investment business, looking for opportunities, visiting properties, negotiating them, financing them, renovating them, leasing them, etc. but they will not deduct any cost of their own time and work.

Since you could have used all this productive time to work a regular job, and earned a salary, you need to deduct this cost from your returns. Your labor is not free in the real world. Otherwise, you’re simply lying to yourself and buying yourself a second job, not making an investment.

And if you deduct the value of your time and work, your returns worsen very materially in most cases.

The second mistake that investors make is that they will ignore the impact of irregular major expenses. Once in 5-10 years, you will encounter a very big expense item. As an example, your roof may need to be changed. You need to average out these costs over your annual returns, but most rental property investors will typically only talk about the returns of their best years.

Bottom line

REITs are more profitable than rentals in most cases and that’s despite being safer and requiring less effort from investors.

I think that especially today, they are far better investments because they are heavily discounted and often trade at large discounts relative to the value of the real estate they own.

But unfortunately, there are a lot of misconceptions on this topic and this is often causing investors to buy rental properties instead.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.